As joss sticks smoke filled the table during the sexy maths tutor’s romantic Valentine dinner, dense smoke of another kind choked the stale air of the loan shark‘s office, as the love-struck Ah Beng faced up to his boss, surrounded by a dozen or so henchmen whose Marlboro Reds were the source of the high PSI reading.

“WHAAT?! $12000?! YOU WANT ME TO LEND YOU $12K???!“

screamed the loan shark boss, as he flashed the Ah Beng‘s dismal PSLE grades on the overhead projector, in front of all the henchmen.

“Look at your grades! Look at your USELESS self! Who you think you are?!“

*Collective laughter from the henchmen*

“That woman’s a university graduate and a sexy maths tutor with more than 17 years’ of experience! You’re just a pathetic Ah Beng! YOU’LL NEVER BE ABLE TO CATCH UP! I think you’re better off collecting debts for me – for this year I want a 100% debt-collection success rate for my gang!“

The Ah Beng stood there with his head bowed and fists clenched, like a ‘marked’ student in front of an abusive teacher, silently taking in all the humiliation and mockery thrown at him.

After what seemed like an eternity, however, the loan shark began to admire the Ah Beng‘s stubbornness single-mindedness and softened his stance.

For his loan of $12000, the loan shark boss offered him his ‘special’ loan shark runner package of either

- Simple interest rate of 300% per annum.

- Or a compound interest of 60% per annum, to be compounded monthly.

The entire sum plus interest is to be repaid at one go in 4 years 6 months.

Which option should the Ah Beng take?

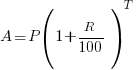

NOTE: Though the Ah Beng had long memorized the formulae of simple interest ( ) and compound interest (

) and compound interest ( ) through his debt-collection runs and frequent eavesdropping on the maths tutor’s lessons, he crucially missed the lesson yesterday when the tutor was discussing a secondary three exam question from a particular school which involved interest that was compounded monthly.

) through his debt-collection runs and frequent eavesdropping on the maths tutor’s lessons, he crucially missed the lesson yesterday when the tutor was discussing a secondary three exam question from a particular school which involved interest that was compounded monthly.

Also, like many students that the maths tutor had taught, there is a grave danger that the Ah Beng will get confused as to whether each formula calculates only the interest or the total amount.

Miss Loi is a full-time private tutor in Singapore specializing in O-Level Maths tuition. Her life’s calling is to eradicate the terrifying LMBFH Syndrome off the face of this planet. For over years she has been a savior to countless students …

Miss Loi is a full-time private tutor in Singapore specializing in O-Level Maths tuition. Her life’s calling is to eradicate the terrifying LMBFH Syndrome off the face of this planet. For over years she has been a savior to countless students …

20 Comments

曜

日

hahahaha...looks like our dramatic sexy maths tutor is at it again 🙂

曜

日

You know, it's getting harder and harder to transpose your stories into machinima now... :p

曜

日

HighwayBlogger: The Ah Beng is in danger of falling too 'deep'! Perhaps you can offer him some 'investment' advice?

FoxTwo: Your video budget allows for a supercar but not an overhead projector?

曜

日

In this case, too much talking, not the OHP thing. With this much dialogue going on, having audible dialogue (ie recorded voices) is much more preferable to using subtitles to simulate conversation. Getting voice actors is a BIG problem here in Singapore - people simply too shy to want to volunteer for it. We definitely can't have ah bengs talking with American accents (where there are an abundance of volunteers for voice actors in machinimas).

And besides, Ah Long San won't ever use OHP anyway, and school grades won't ever be a factor in the "discussion" LOL. They'll just kidnap you and tie you up in a dingy dark damp basement somewhere and perform unspeakable acts on you 🙂

曜

日

At 300% I will end up with s$48k but with 60% pa compounded at least not so much! Hemmmm!!! So what they say is corrected! 'Chasing' S'porean lady is like selling urself to loan shark first!

Ok! Any loan shark want the service of 'hor ny ang moh'!!! Not schoolling cert! But I got years of 'sexepriance' which is 'priceless'!!! In exchange for my 'pokeing' service I will like to borrow s$12k interest free so that I can 'chase' after this 'se*xy' math tutor!!!

My 'pokeing' service rate is s$50 per hour at normal week day but I only poke on alternate week! Week end is s$80 per hour! However if the client is 'good' then special rate is offered at s$150 per two hour!

To any loan shark who is interested in my 'service' which 'package' should u choose so that u get the most 'bang for money' & get the returned soonest possible???

He! He! Miss Loi which 'package' will u choose???

曜

日

FoxTwo, you should know the meaning of the OHP right? 😉

HAM, with your (sadly mistaken) way of calculating simple and compound interest every

bankloan shark will be happy to have you as their client!And sigh ... all your 'good behaviour' for the past month thrown out of the window in one fell swoop. Time to return to your rehab center. *shakes head*

曜

日

Hi,

It is often said that credit-card companies charge even higher interest rates (@24% per annum) than loan sharks...so isn't it a good exercise to compare the interest rates of a licensed moneylender and an unlicensed one? =)

曜

日

Welcome to Jφss Sticks euefo!

Umm ... Miss Loi hasn't had the chance to be in smoke-filled offices often enough to know first-hand the interest rate fluctuations of the unlicensed ones.

But having been a 24% p.a. victim herself, she deduced that they both follow the same formula and business model.

The only difference is probably you can smoke your Marlboro Reds in one office but not the other.

曜

日

why the story getting complicated one... hmm why abt plotting one on mother and daughter? keke

曜

日

yalor why de ish de story so..monetarily nefarious one why not a story of carebears LOL!!

曜

日

Hello Cendrine! Mother and daughter not yet, but father and son are screening now 😀

曜

日

Kiroii, yeah it's a little tragic but lurve always happens in the most unlikely of circumstances. Moreover, if you've read through this tag, you'll know that Care Bears will never make it into Miss Loi's agenda 😉

曜

日

Well well...LOL "unlikely of circumstances" ? Thats kinda perverse if you ask me lolz i thought girls in contemporary like to be pragmatic - "no $ no honey"

曜

日

poor ah beng. missed his lesson.

compound is better rite?

曜

日

wow! sup rokok! (:

曜

日

Hello jr. Care to show how you found that compound is the better option? The difference between the two should be pretty close 😉

TOH KIAT SHENG KEN: If you can solve this sad, sad question, you'd discover that either way the poor Ah Beng will have no money left for rokok.

曜

日

For 1. iff p.a. = per integral year

total amount to pay ($) =

iff p.a. = per non-integral year

total amount to pay ($) =

Nice of you to add the calculation based on per integral year (which simply entails rounding down to the nearest whole year when calculating the interest). Banks would love to use this method when calculating the interest owed to you as they will save a tidy sum should you withdraw your money before the year is up!

HOWEVER in the context of general O-Level questions, calculations should be done as per non-integral year as detailed by you above (so the answer is a total $174000 owed in 4 yrs 6 mths' time based on simple interest). The loanshark wouldn't be so stupid to throw away 6 months' worth of interest away!

POTENTIAL CARELESS MISTAKE: Many students are so used to the simple interest formula appearing in textbooks everywhere that they sometimes forget to add the principal some of $12000 to their final answer!

appearing in textbooks everywhere that they sometimes forget to add the principal some of $12000 to their final answer!

For 2. total amount to pay ($) = (cor. to 4 d.p.)

(cor. to 4 d.p.)

Yes, the usual practice in the exam when you encounter interest that's compounded monthly is to simply divide the yearly interest rate (60% in this case) by 12 months, and make sure your Time T is now in months.

POTENTIAL CARELESS MISTAKE (again): This time the compound interest formula appearing in textbooks everywhere already takes into account the principal sum. So you DO NOT have to add $12000 to your final answer (which is $167264.35 as worked out above)! What a way for textbooks to confuse our poor students huh? 😕

appearing in textbooks everywhere already takes into account the principal sum. So you DO NOT have to add $12000 to your final answer (which is $167264.35 as worked out above)! What a way for textbooks to confuse our poor students huh? 😕

iff = if and only if.

.'. iff p.a.=per integral year: simple interest

else: compound interest

As I thought that well, loan sharks suck as much money as possible, I included both even though only one could be chosen in the public exam.

One again in the context of the exam questions, compound interest is the way to go ($167264.35 vs $174000) for the Ah Beng. But seriously he should just forget about the whole idea and go learn some financial planning instead 😛

Ah and one more thing: Some time ago at my school (not in Singapore, so just for interest), I attended a math activity on loans by loan sharks:

Effective Interest Rate:

the number of compounding periods per year

the number of compounding periods per year

where

r = interest rate for a single period,

f = frequency of compounding, i.e. the number of years

For instance, what is the EIR for 12% compounded quarterly?

Answer:

quarters = 3% per quarter

quarters = 3% per quarter

Stated interest is 12%;

f = 4 (i.e. quarterly)

Effective rate =

.'. effective rate = 12.55%

The loan sharks love this:[no wonder they're called 大耳窿 (lit. big EAR holes) '.' got so many bucks and pierced big EAR holes]

Effective Annual rates (EARs) where m = number of periods per year.

where m = number of periods per year.

APR: annual percentage rate, the “total” rate per year.

Case in point: A bank charges 1% per month on a certain loan. Find the APR and EAR.

Answer:

APR=

EAR=

Then this year the bank changes the terms: on agreeing to the loan, one gets $1,000 instant credit; the bank claims, "12% simple interest! 3 years to pay! Low, low monthly payment!" How much will the debtor owe at the end of the 3 years and is it really a 12%-simple-interest-based loan?

The debtor owes

(yes, these money suckers love rounding everything UP.)

(yes, these money suckers love rounding everything UP.)

Each month the debtor must pay

Is this a 12% loan? Let's see:

This is the step that transforms the innocent-looking interest rate into a astronomical 天文数字 effective rate. Care to elaborate how you derived this?

APR =

EAR =

But limit of EAR is where q is the quoted rate; e: base of the natural log.

where q is the quoted rate; e: base of the natural log.

曜

日

*Struts boldly in to comment on fggffggf's solution - since she's already been caught by fggffggf sneaking in quietly*

In any case, may this example demonstrate to all the potentially snowballing effect of a 'low' quoted interested rate (monthly? daily? hourly?) over a extended period of time T.

Woe to the

大耳窿sbanks大耳窿sbanks大耳窿s! *getting confused* 😛曜

日

The EAR and APR stuff came from the notes the math panel teacher gave me. I just didn't want to make the whole thing so complicated so I summed it up. And I will be shutting down my old blog soon so just call me Li-sa, my actual cyber-name. You can find me in squareCircleZ; it's the same person.

My teacher also dares to write comments boldly. Once I did my work very messily and she wrote on a separate page forcefully (poor paper...I love paper): "IF YOU DON'T TIDY UP YOUR WORK, I WON'T MARK YOUR EXERCISE BOOK ANYMORE." I was so afraid I succumbed to writing *nicely*. It's okay to comment fearlessly; it shows you are brave enough to save, like superheroes. Do they tiptoe into castles and rescue damsels in distress? Hardly ever.

Just call me Li-sa.

曜

日

Haha Li-sa as you probably know Miss Loi has been pretty overwhelmed for the past week and so she only has time to 'sneak' in a reply or two each night to the questions that you did 🙂

But now that the dust has somewhat settled, think it's time to start blogging again - Miss Loi misses this place! *embraces computer screen*